ETH bulls target $9K: Does the data support the lofty price target?

Ether is gaining momentum as supply constraints, surging demand, and bullish technical indicators converge, with ETH potentially targeting $9,000.

Key takeaways:

- ETH has surged 50% in just two weeks, with Elliott Wave analysis suggesting a possible peak of $9,000 by early 2026.

- Onchain fundamentals remain robust: 28% of ETH is staked, exchange reserves have hit their lowest level since 2016, and new investor inflows are accelerating.

- Despite multiple increases in block gas limits, network usage continues to operate near full capacity, underscoring sustained demand.

After a sluggish market cycle, $ETH’s 50% rally in two weeks has reignited investor interest. Yet, at $3,730, ETH remains 23% below its November 2021 all-time high. Analysts now speculate that its price could more than double from current levels.

Is Ethereum’s biggest rally still ahead? Onchain data, trading activity, and blockchain metrics all indicate that this uptrend may only be in its early stages.

ETH charts signal undervaluation

Despite its strong rally, ETH continues to trail broader market momentum. Glassnode data shows the MVRV Z-score — measuring Ethereum’s market cap against its realized cap (total capital invested) — remains significantly below previous cycle peaks. While ETH has exited the "bearish" zone, it still trades far from levels typically seen at market tops, suggesting room for further upside.

ETH MVRV Z-score. Source: Glassnode

Compared to Bitcoin, ETH remains significantly behind. Over the past year, BTC surged 74% while ETH declined 28%, widening the performance gap. However, BTC’s dominance now sits at historically high levels, suggesting ETH may be under-owned and undervalued. Analysts at Bitcoin Vector note that ETH appears primed for a catch-up rally, potentially signaling an upcoming market rotation.

In the near term, $4,000 serves as a crucial psychological and technical resistance level. A decisive breakout above this threshold could trigger accelerated upward momentum.

From a technical standpoint, Elliott Wave theory—which identifies recurring five-wave price patterns driven by market psychology—suggests ETH is currently in its third impulsive wave. An analysis by XForceGlobal (partially validated but slightly ahead of schedule) projects this phase could propel ETH toward $9,000 by early 2026, assuming supportive macro conditions. If this pattern holds, Ethereum could see a major breakout before the next market correction.

Onchain data confirms ETH's bullish momentum is structural, not just speculative

- Staking demand remains strong: Over 34 million ETH (28% of total supply) remains locked in staking, reducing circulating liquidity and demonstrating long-term holder conviction.

- Exchange reserves hit historic lows: Only 16.2 million ETH sits on exchanges—the smallest balance since 2016. This supply squeeze could amplify upward price pressure as demand increases.

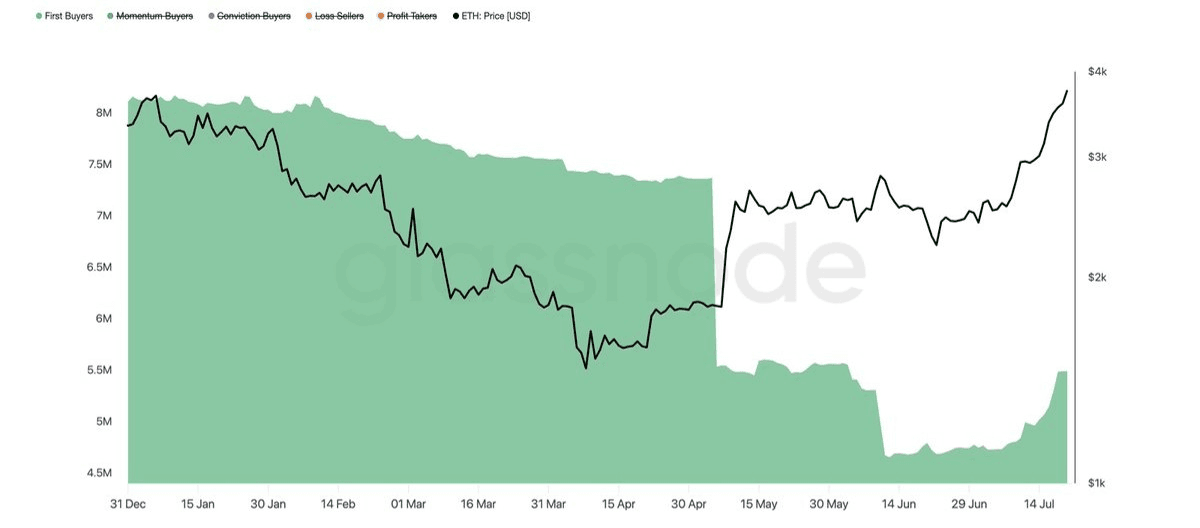

- New buyers are entering the market: Since early July, first-time ETH holders have surged ~16%, signaling renewed retail interest. Glassnode analysts highlight this as the first clear trend reversal in recent months.

These fundamentals suggest ETH's rally is supported by real capital inflows and supply constraints, not just speculative trading. With shrinking liquidity and growing adoption, the setup favors continued upside.

ETH supply by investor behavior: first buyers. Source: Glassnode

Ethereum activity: capacity expands, and demand keeps up

Beyond speculation, Ether’s value depends on actual usage, and that activity is growing in subtle but significant ways.

While average transaction fees have dropped to historic lows—just 0.0004 ETH per transfer—that doesn’t mean Ethereum is quiet. Rather, it reflects improved efficiency, especially with much of the load now handled by layer 2s. To properly gauge demand on the network, fees in ETH can mislead; gas offers a clearer view of the actual computational work being consumed.

You may also like

PAXG & WEEX Zero-Fee Gold Futures: A Practical PAXG Guide for Traders and Investors (2026)

PAXG explained: what PAX Gold is, how it tracks real gold, PAXG price prediction for 2026, comparison with gold ETFs and physical gold, and the WEEX zero-fee futures event on PAXG, XAUT, and XAGU.

Quantum Computing vs Bitcoin in 2026: The Reality Behind the Q-Day Hype

Is quantum computing a real threat to Bitcoin in 2026? This analysis explains the hardware gap, qubit estimates, exposed-key risk, testnet findings, and a practical migration playbook for wallets, exchanges, and holders—actionable guidance to stay quantum-safe.

MOLTEN USDT Debuts Exclusively on WEEX as Molten (MOLTEN) Premieres

Exciting news for crypto traders: WEEX Exchange has just launched the exclusive initial listing of Molten (MOLTEN) Coin…

What Is Warrior (WAR) Coin? Exploring Its Basics and Investment Potential

Warrior (WAR) Coin has been quietly making waves in the crypto space, especially among enthusiasts looking for low-cap…

What Is Hedera (HBAR) Coin? Exploring HBAR’s Basics, Price Trends, and Investment Potential

Hedera (HBAR) coin has been making waves in the crypto space lately, especially with its recent price uptick…

What Is Bitcoin Hyper (HYPER)? Exploring the Token and Its Investment Potential

Bitcoin Hyper (HYPER) has been making waves in the crypto space lately, especially after its recent listing on…

What Is STABLE? Exploring the Crypto Token and Its Investment Potential

As of February 10, 2026, the STABLE token has caught attention with a notable 19.56% price surge in…

Superform (UP) Coin Price Prediction & Forecasts for February 2026: Could It Surge Amid DeFi Neobank Hype?

Superform (UP) just hit the trading floor on WEEX Exchange today, February 10, 2026, marking its entry into…

What is Superform (UP) Coin?

We are thrilled to announce the recent addition of the Superform (UP) coin to the WEEX exchange platform.…

WEEX Debuts UP USDT: Superform (UP) Coin Initial Listing

WEEX Exchange is thrilled to announce the world premiere listing of Superform (UP) Coin, opening UP USDT trading…

Espresso (ESP) Coin Price Prediction & Forecasts for February 2026: Can It Surge Amid Rollup Innovations?

Espresso (ESP) has just hit the trading scene with its listing on WEEX Exchange today, February 10, 2026,…

What is Espresso (ESP) Coin?

Espresso (ESP) Coin has officially hit the crypto scene with its launch on the WEEX Exchange on February…

ESP USDT Premieres on WEEX: Espresso (ESP) Coin Initial Listing

WEEX Exchange proudly announces the initial listing of Espresso (ESP), a groundbreaking Rollup platform trusted by industry leaders…

MOLTEN Coin Price Prediction & Forecasts for February 2026 – Fresh Listing Sparks Potential Rally

Molten (MOLTEN) just went live for trading on WEEX Exchange today, February 10, 2026, marking its debut in…

What Is Molten (MOLTEN) Coin?

We are thrilled to announce the new trading debut of Molten (MOLTEN) on WEEX Exchange, marking its live…

Top AI Crypto Projects for 2026: The Ultimate Guide to AI Altcoins

AI + crypto in 2026: discover the top projects to watch—Render (RNDR) for distributed GPU inference, Ocean Protocol for compute-to-data, SingularityNET for model marketplaces, Fetch.ai for autonomous agents. Learn evaluation criteria, due diligence checklist, and concrete signals that separate real infrastructure from hype.

What Is RWA (Real-World Asset Tokenization)? The Biggest Opportunities in 2026

What is RWA (real-world asset tokenization)? Learn how tokenized real estate, tokenized bonds, and tokenized gold work, the biggest RWA crypto opportunities in 2026, risks, returns, and how beginners can invest safely in RWA projects.

What is Juno Agent (JUNO) Coin?

Exciting news for crypto enthusiasts: Juno Agent (JUNO) has recently been listed on WEEX! As of February 10,…

PAXG & WEEX Zero-Fee Gold Futures: A Practical PAXG Guide for Traders and Investors (2026)

PAXG explained: what PAX Gold is, how it tracks real gold, PAXG price prediction for 2026, comparison with gold ETFs and physical gold, and the WEEX zero-fee futures event on PAXG, XAUT, and XAGU.

Quantum Computing vs Bitcoin in 2026: The Reality Behind the Q-Day Hype

Is quantum computing a real threat to Bitcoin in 2026? This analysis explains the hardware gap, qubit estimates, exposed-key risk, testnet findings, and a practical migration playbook for wallets, exchanges, and holders—actionable guidance to stay quantum-safe.

MOLTEN USDT Debuts Exclusively on WEEX as Molten (MOLTEN) Premieres

Exciting news for crypto traders: WEEX Exchange has just launched the exclusive initial listing of Molten (MOLTEN) Coin…

What Is Warrior (WAR) Coin? Exploring Its Basics and Investment Potential

Warrior (WAR) Coin has been quietly making waves in the crypto space, especially among enthusiasts looking for low-cap…

What Is Hedera (HBAR) Coin? Exploring HBAR’s Basics, Price Trends, and Investment Potential

Hedera (HBAR) coin has been making waves in the crypto space lately, especially with its recent price uptick…

What Is Bitcoin Hyper (HYPER)? Exploring the Token and Its Investment Potential

Bitcoin Hyper (HYPER) has been making waves in the crypto space lately, especially after its recent listing on…