Litecoin Price Prediction: 2025-2030 Analysis – Is It Worth Investing Now?

Litecoin (LTC) has been a prominent cryptocurrency in the market, often regarded as the silver to Bitcoin’s gold. As we look ahead to the years 2025 to 2030, many investors are curious about its potential price movements. In this comprehensive guide, we’ll analyze Litecoin’s price prediction, covering the latest market trends, technical analysis, and fundamental factors driving LTC's price. Whether you're considering short-term trading or long-term holding, this article will provide the insights you need to make informed decisions about Litecoin investments.

Litecoin Market Overview

Litecoin (LTC token) was launched in 2011 by Charlie Lee as a peer-to-peer cryptocurrency, quickly becoming one of the top cryptocurrencies by market cap. Known for its fast transaction speeds and lower fees compared to Bitcoin, Litecoin has been a reliable alternative in the crypto ecosystem. Here’s the current market status of Litecoin:

- Current Price: $102.27

- Market Cap: $7,733,417,063

- 24-Hour Trading Volume: $1,108,764,071

- Circulating Supply: 75,598,758 LTC

- Max Supply: 84,000,000 LTC

In the last 24 hours, Litecoin has seen fluctuations, ranging between $95.46 and $106.69. As a relatively established cryptocurrency, Litecoin has a solid presence in the market, making it a reliable candidate for long-term investment.

LTC Token Historical Performance

Litecoin has experienced both significant highs and lows. The most notable peak occurred in May 2021, when LTC reached an all-time high of $410.26, a massive increase from its low of $1.15 in January 2015. This volatility has been typical of many cryptocurrencies, but Litecoin’s resilience has kept it in the top 25 coins by market capitalization.

As of now, Litecoin is trading at approximately 75.2% below its all-time high. This provides an interesting opportunity for potential investors, as it reflects the potential for future growth should market conditions improve.

Litecoin Fundamental Analysis

To understand where Litecoin’s price could be headed, it’s essential to examine its fundamental aspects.

- Project Overview: Litecoin is often seen as a "lighter" version of Bitcoin. It uses a similar proof-of-work consensus mechanism, but with faster block generation times and a different hashing algorithm (Scrypt), which makes it more accessible for mining.

- Technology & Team: The development of Litecoin is ongoing, with regular updates to improve scalability and transaction speeds. It benefits from strong leadership and a dedicated community, but it is often seen as being overshadowed by Bitcoin and Ethereum in terms of major technological breakthroughs.

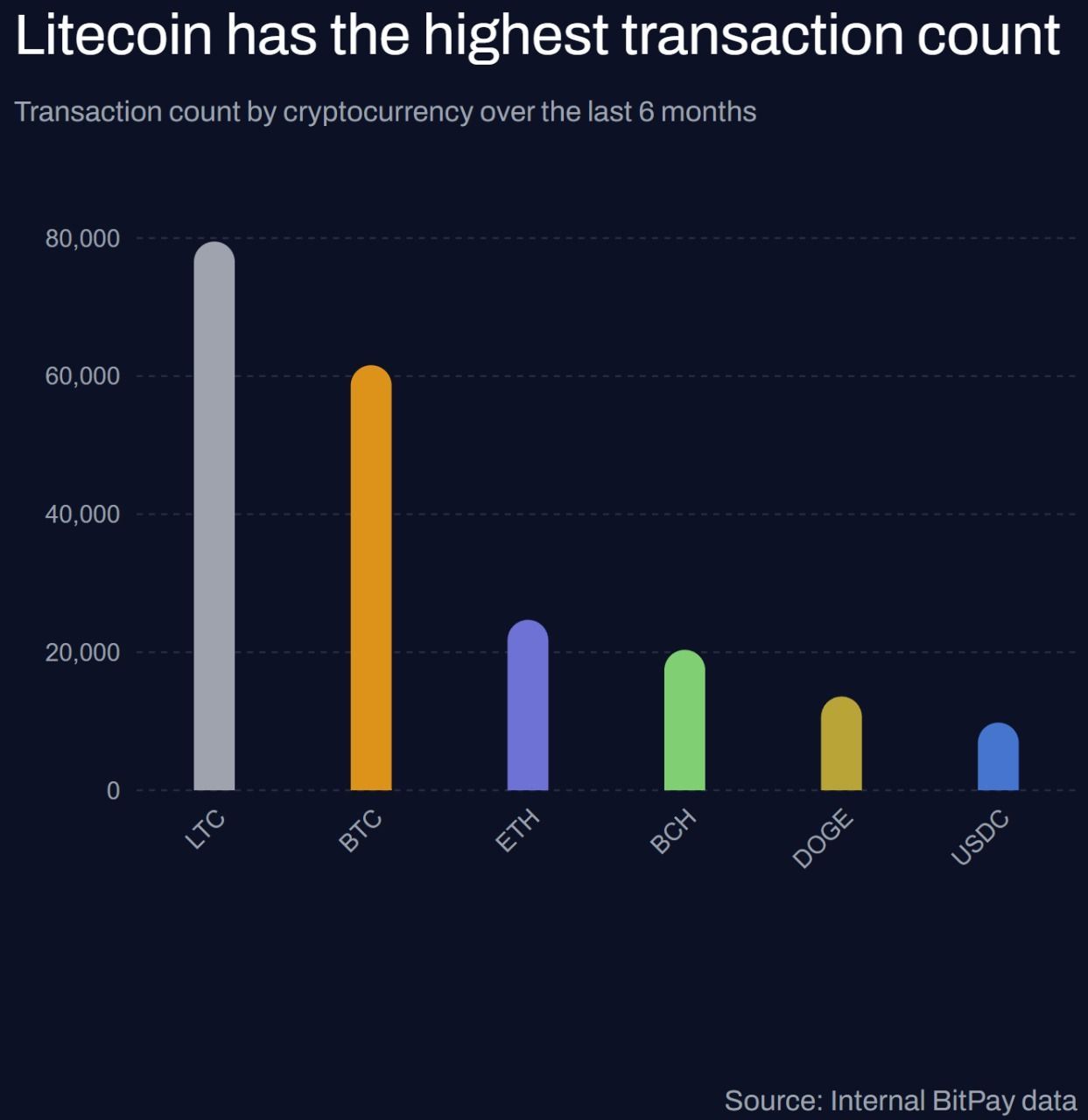

- Market Demand: Litecoin has a unique position in the market due to its emphasis on fast transactions and lower fees, which make it attractive for everyday use and as a potential medium of exchange.

- Potential Risks: One of the primary risks for Litecoin is the competition from other cryptocurrencies and the overall market's volatile nature. Regulatory scrutiny on cryptocurrencies also poses risks to Litecoin’s price.

What Makes LTC Token Unique?

Litecoin’s fast transaction speeds and low fees have made it a popular choice for both users and developers. Unlike Bitcoin, which has longer transaction times and higher fees due to network congestion, Litecoin is often seen as more suitable for smaller transactions. Litecoin has also been a proving ground for several innovations in the cryptocurrency space, such as SegWit and the Lightning Network.

Key Factors Driving LTC Token Demand

Several factors contribute to Litecoin’s continued demand in the market:

- Transaction Efficiency: Litecoin’s ability to handle higher transaction throughput with lower fees makes it an appealing choice for users and businesses.

- Security and Stability: The Litecoin network is highly secure and has proven to be reliable over the years.

- Increased Adoption: As more companies and merchants begin accepting Litecoin, its demand is expected to rise.

Risks & Challenges

Despite its advantages, Litecoin faces several risks:

- Regulatory Uncertainty: Governments worldwide are still trying to establish clear regulations for cryptocurrencies, and any major regulatory changes could impact Litecoin’s market price.

- Competition from Other Cryptos: Newer cryptocurrencies and blockchain technologies could present strong competition to Litecoin’s dominance in the market.

- Market Volatility: As with all cryptocurrencies, Litecoin is subject to significant price fluctuations, which can pose challenges for short-term investors.

Litecoin Technical Analysis

In addition to fundamental factors, Litecoin’s price movements can be influenced by technical aspects. Let’s dive into the technical analysis:

- Support & Resistance Levels: Litecoin’s recent price range has seen it hover between $95.46 and $106.69. Key support levels are around $95, while resistance levels lie close to the $110 mark.

- Moving Averages: The 50-day moving average recently crossed above the 200-day moving average, indicating a bullish trend in the medium term.

- Historical Trends: Litecoin’s long-term historical trend suggests that, while there are periods of significant volatility, it has shown the potential for recovery and growth following price dips.

Litecoin Price Prediction (2025-2030)

Looking ahead, let’s break down Litecoin’s potential price predictions from 2024 to 2030:

- 2025 Price Prediction: Litecoin could experience significant growth, with a forecasted price range between $150 and $180. The increase will likely be driven by growing global crypto adoption, continued network upgrades, and broader market trends.

- 2026 Price Prediction: By 2026, Litecoin’s price may range between $190 and $220, with growth fueled by its increasing role in decentralized finance (DeFi) platforms, technological advancements, and improved market conditions.

- 2030 Price Prediction: Long-term projections suggest that Litecoin could reach prices between $250 and $300 by 2030, assuming continued market expansion and Litecoin’s steady position as a reliable alternative to Bitcoin.

What Impacts Litecoin’s Price?

Several factors can influence Litecoin’s price over the next few years:

- Network Upgrades: Technological improvements such as the implementation of the Lightning Network and potential scalability upgrades can drive LTC's demand and, consequently, its price.

- Bitcoin’s Influence: As Bitcoin often leads market trends, any price surges or crashes in Bitcoin’s price will likely affect Litecoin’s price as well.

- Regulatory & Economic Factors: Global regulations, particularly those targeting cryptocurrencies, can have significant effects on Litecoin’s market performance.

Should You Invest in Litecoin?

Litecoin remains a promising cryptocurrency for both short-term traders and long-term holders. Here’s how you might approach investing in LTC:

- Short-Term Investors: If you're interested in capitalizing on price swings, Litecoin's established position and historical trends may provide opportunities for gains in the short term.

- Long-Term Investors: For those willing to hold through volatility, Litecoin’s potential for growth over the next decade could prove rewarding as the broader cryptocurrency market continues to mature.

Final Thoughts on LTC Token Investment

Litecoin remains one of the most established and reliable cryptocurrencies in the market. While it faces challenges and competition, its unique value proposition of faster transaction speeds and lower fees continues to drive demand. If you're looking for a solid long-term investment in the cryptocurrency space, Litecoin’s strong fundamentals and history of resilience make it an attractive option.

Latest Updates on WEEX

WEEX Exchange’s WXT Token Surges 101%

If you want to buy WXT now, you can sign up for a WEEX account

WEEX Owen: Michael Owen Joins as Global Brand Ambassador

Championing a revolutionary crypto trading experience

You may also like

Does WEEX Require KYC? Complete Guide

KYC is not mandatory on WEEX Exchange, providing traders with flexibility to begin trading immediately while choosing when to complete full verification. This approach balances accessibility with security, allowing users to maintain privacy while offering significant benefits for those who verify their identity.

What is Kumbaya Pump Initiative (KPI) Coin?

Kumbaya Pump Initiative (KPI) has recently captured the spotlight as a newly listed token pair on WEEX. As…

KPI USDT Trading Debuts on WEEX: List Kumbaya Pump Initiative (KPI)

WEEX Exchange is excited to announce the listing of Kumbaya Pump Initiative (KPI) Coin, opening up new trading…

Kumbaya Pump Initiative (KPI) Coin Price Prediction & Forecasts: Surging 25% Post-Launch in February 2026

Kumbaya Pump Initiative (KPI) Coin burst onto the scene with its listing on WEEX Exchange on February 10,…

How to Buy Crypto on WEEX Exchange 2026: Complete Guide

Learn how to buy crypto on WEEX Exchange with our 2026 guide. Buy Bitcoin instantly with low fees, secure 2FA & $200M insurance. Step-by-step tutorial for beginners. Available in 150+ countries. Start today!

Is XAG Silver Safe? Evaluating Tokenized Silver Security and Risks in 2026

Is XAG silver safe in 2026? Read our comprehensive analysis of tokenized silver security, blockchain risks, and issuer transparency. Learn how to trade silver safely with zero fees on WEEX.

Is XAUT Backed by Gold? 2026 Tether Gold Guide & Tips

Discover if XAUT is backed by real gold in 2026. This guide explores Tether Gold transparency, Swiss vault security, and how to trade with zero fees on WEEX to maximize your investment rewards.

Silver XAG Forecast Fed Decision 2026: Navigating Market Volatility and Trading Opportunities

Discover the expert silver xag forecast fed decision 2026. Learn how interest rates and industrial demand impact XAG prices. Trade silver futures with zero fees on WEEX!

Is XAG Silver a Stock? Understanding the Difference Between Commodities and Equities

Is XAG Silver a stock? Learn the essential differences between XAG commodity trading and silver equities. Discover silver stock alternatives and how to trade XAG with zero fees on WEEX in 2026.

PAXG & WEEX Zero-Fee Gold Futures: A Practical PAXG Guide for Traders and Investors (2026)

PAXG explained: what PAX Gold is, how it tracks real gold, PAXG price prediction for 2026, comparison with gold ETFs and physical gold, and the WEEX zero-fee futures event on PAXG, XAUT, and XAGU.

Quantum Computing vs Bitcoin in 2026: The Reality Behind the Q-Day Hype

Is quantum computing a real threat to Bitcoin in 2026? This analysis explains the hardware gap, qubit estimates, exposed-key risk, testnet findings, and a practical migration playbook for wallets, exchanges, and holders—actionable guidance to stay quantum-safe.

MOLTEN USDT Debuts Exclusively on WEEX as Molten (MOLTEN) Premieres

Exciting news for crypto traders: WEEX Exchange has just launched the exclusive initial listing of Molten (MOLTEN) Coin…

What Is Warrior (WAR) Coin? Exploring Its Basics and Investment Potential

Warrior (WAR) Coin has been quietly making waves in the crypto space, especially among enthusiasts looking for low-cap…

What Is Hedera (HBAR) Coin? Exploring HBAR’s Basics, Price Trends, and Investment Potential

Hedera (HBAR) coin has been making waves in the crypto space lately, especially with its recent price uptick…

What Is Bitcoin Hyper (HYPER)? Exploring the Token and Its Investment Potential

Bitcoin Hyper (HYPER) has been making waves in the crypto space lately, especially after its recent listing on…

What Is STABLE? Exploring the Crypto Token and Its Investment Potential

As of February 10, 2026, the STABLE token has caught attention with a notable 19.56% price surge in…

Superform (UP) Coin Price Prediction & Forecasts for February 2026: Could It Surge Amid DeFi Neobank Hype?

Superform (UP) just hit the trading floor on WEEX Exchange today, February 10, 2026, marking its entry into…

What is Superform (UP) Coin?

We are thrilled to announce the recent addition of the Superform (UP) coin to the WEEX exchange platform.…

Does WEEX Require KYC? Complete Guide

KYC is not mandatory on WEEX Exchange, providing traders with flexibility to begin trading immediately while choosing when to complete full verification. This approach balances accessibility with security, allowing users to maintain privacy while offering significant benefits for those who verify their identity.

What is Kumbaya Pump Initiative (KPI) Coin?

Kumbaya Pump Initiative (KPI) has recently captured the spotlight as a newly listed token pair on WEEX. As…

KPI USDT Trading Debuts on WEEX: List Kumbaya Pump Initiative (KPI)

WEEX Exchange is excited to announce the listing of Kumbaya Pump Initiative (KPI) Coin, opening up new trading…

Kumbaya Pump Initiative (KPI) Coin Price Prediction & Forecasts: Surging 25% Post-Launch in February 2026

Kumbaya Pump Initiative (KPI) Coin burst onto the scene with its listing on WEEX Exchange on February 10,…

How to Buy Crypto on WEEX Exchange 2026: Complete Guide

Learn how to buy crypto on WEEX Exchange with our 2026 guide. Buy Bitcoin instantly with low fees, secure 2FA & $200M insurance. Step-by-step tutorial for beginners. Available in 150+ countries. Start today!

Is XAG Silver Safe? Evaluating Tokenized Silver Security and Risks in 2026

Is XAG silver safe in 2026? Read our comprehensive analysis of tokenized silver security, blockchain risks, and issuer transparency. Learn how to trade silver safely with zero fees on WEEX.