Grayscale Submits IPO Application: Cryptocurrency Giant with $35 Billion AUM Finally at the Doorstep of the Stock Market

Original Article Title: "Grayscale, Once Tough SEC, is about to Land on the NYSE"

Original Article Author: Eric, Foresight News

On the evening of November 13th, Beijing time, Grayscale submitted an IPO application to the NYSE, planning to debut on the US stock market through Grayscale Investment, Inc. This IPO is led by Morgan Stanley, BofA Securities, Jefferies, and Cantor.

It is worth noting that Grayscale's listing this time adopts an Umbrella Partnership structure (Up-C). In this structure, Grayscale's operational and controlling entity, Grayscale Operating, LLC, is not the listing entity. Instead, the IPO is conducted through a newly established listing entity, Grayscale Investment, Inc., which acquires a portion of LLC's equity to facilitate public trading. The company's founders and early investors can convert their LLC interests into shares of the listing entity, enjoying capital gains tax benefits in the process by only paying personal income tax. IPO investors, on the other hand, need to pay taxes on corporate profits and personal income tax on stock dividends.

Such a listing structure not only benefits the company's "elders" in terms of taxation but also allows for post-listing absolute control through dual-class shares. The S-1 filing shows that Grayscale is wholly owned by its parent company DCG, and Grayscale explicitly states that post-listing, the DCG parent company will retain decision-making control over Grayscale through 100% ownership of B class shares with greater voting rights. The funds raised through the IPO will also be used entirely to purchase equity from the LLC.

Everyone is no stranger to Grayscale, which first launched Bitcoin and Ethereum investment products and, through a tough battle with the SEC, achieved the conversion of Bitcoin and Ethereum trusts into spot ETFs. Its launch of the Digital Large Cap Fund also had the power of a "cryptocurrency version of the S&P 500." During the last bull market cycle, every adjustment to the large-cap fund caused significant short-term price fluctuations for the tokens being removed and added.

S-1 filings show that as of September 30th of this year, Grayscale's total AUM reached $35 billion, making it the world's largest cryptocurrency asset manager. It has over 40 different digital asset investment products covering more than 45 cryptocurrencies. The $35 billion includes $33.9 billion in AUM of ETPs and ETFs (primarily Bitcoin, Ethereum, SOL-related products) and $1.1 billion in private funds (primarily altcoin investment products).

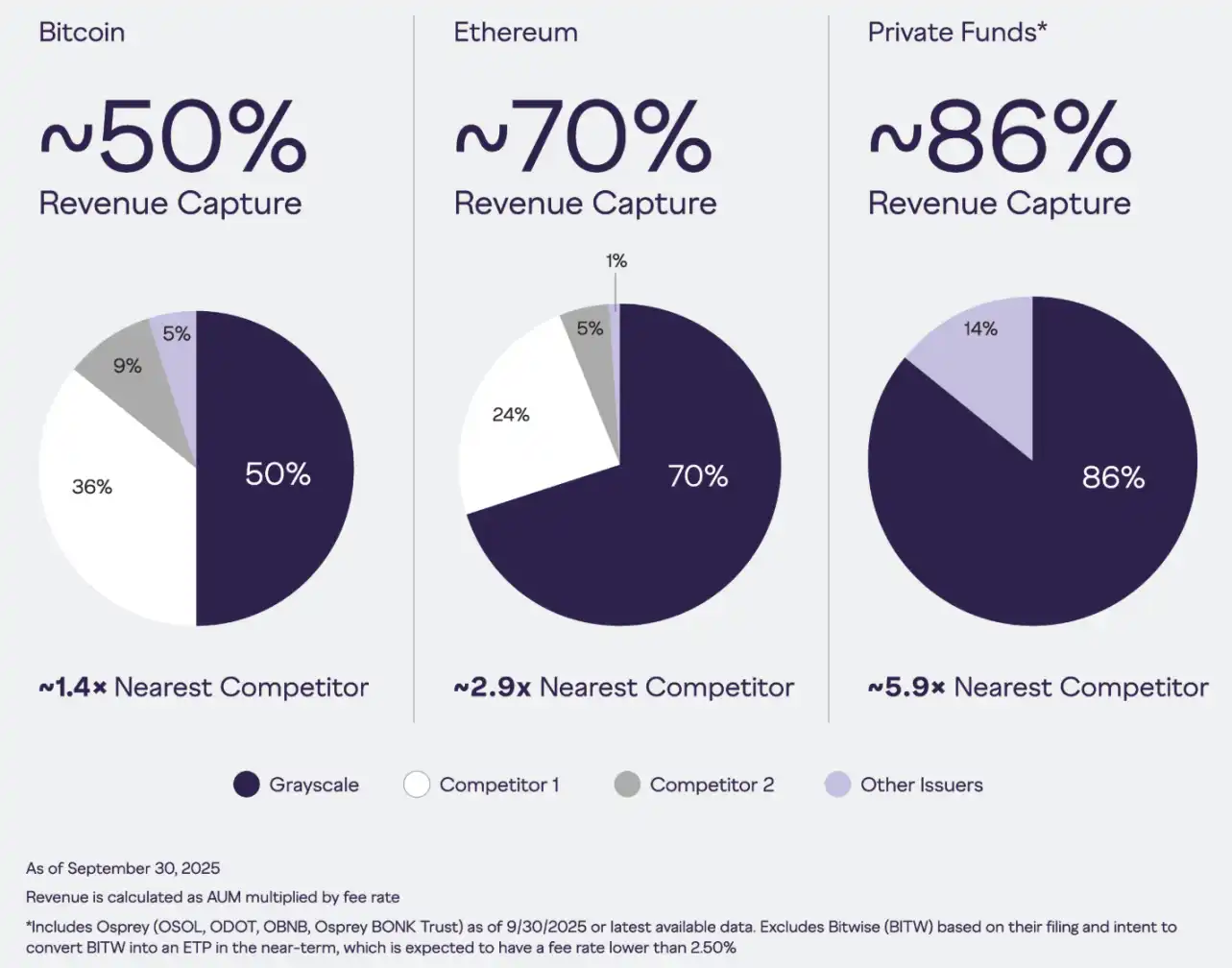

In addition, purely in terms of revenue, Grayscale's main investment products have a stronger revenue-generating capability compared to its primary competitors. However, this is mainly due to the previously non-redeemable trust accumulation of AUM and an above-peer-average management fee.

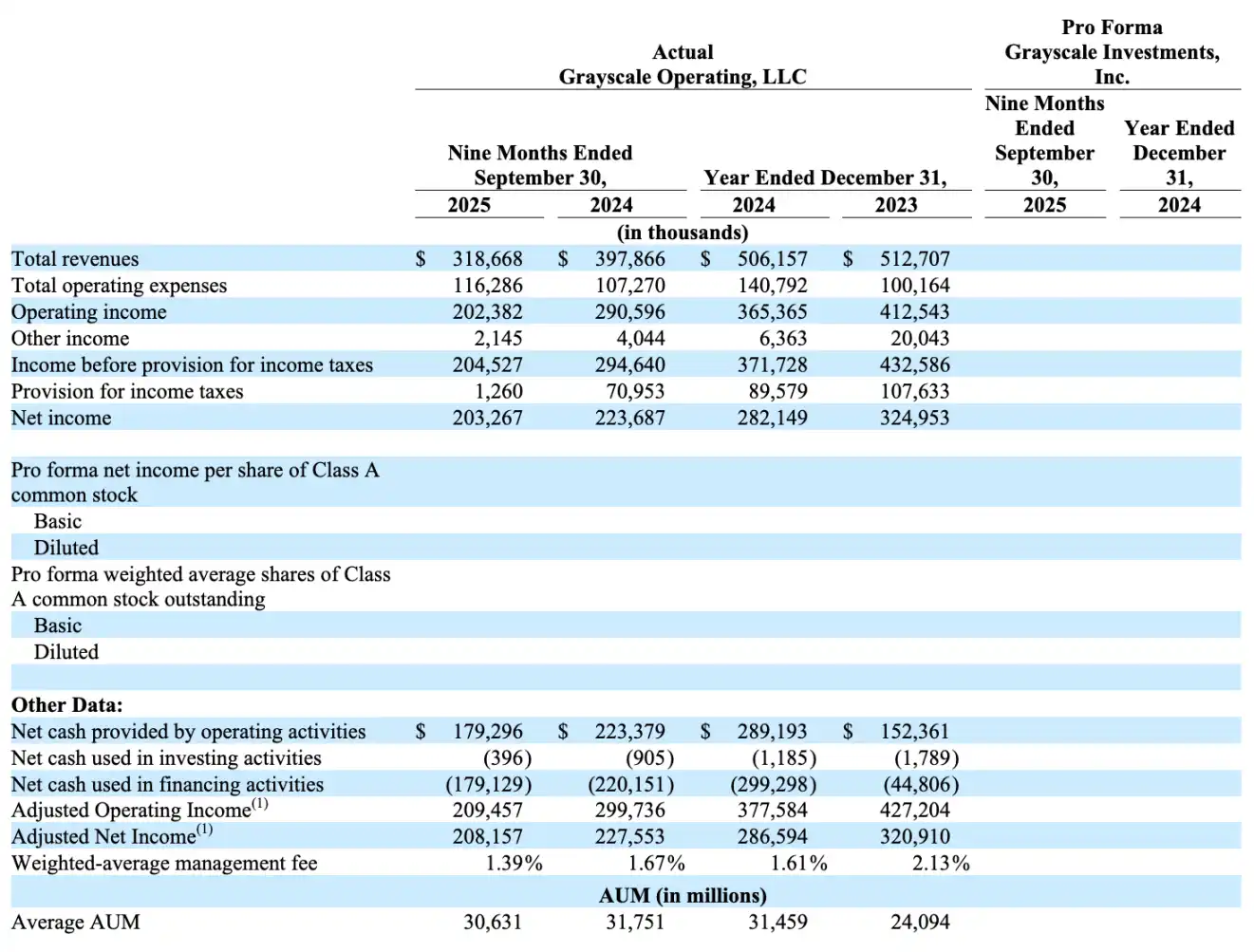

Financially, for the nine months ending September 30, 2025, Grayscale's operating revenue was approximately $3.19 billion, a 20% year-over-year decrease. Operating expenses were around $1.16 billion, an 8.4% year-over-year increase. Operating profit stood at about $2.02 billion, a 30.4% year-over-year decrease. Including other income and deducting the provision for income taxes, the net profit was approximately $2.03 billion, down 9.1% year-over-year. Additionally, average AUM data indicates a possible decrease in AUM compared to last year.

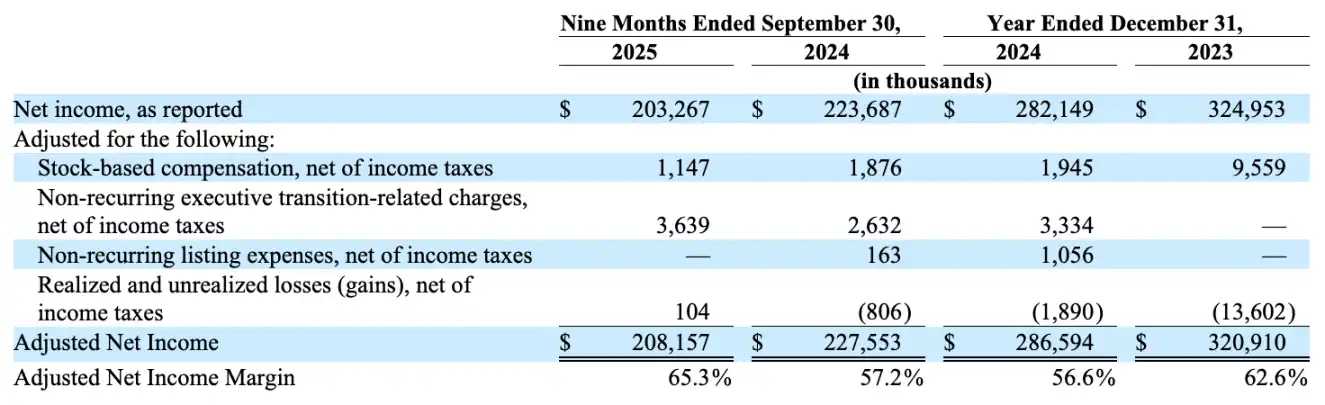

Excluding non-recurring items, the adjusted net profit for the reporting period was about $2.08 billion, with a net profit margin of 65.3%. Although the former decreased by 8.5% year-over-year, the net profit margin increased compared to the same period last year at 57.2%.

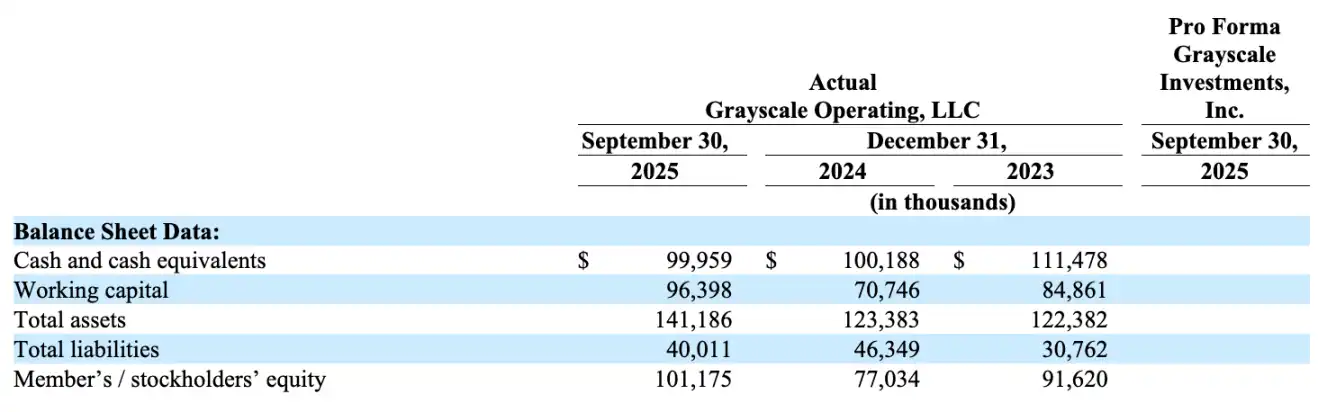

Currently, Grayscale's debt ratio is quite healthy. Despite a decline in revenue and profit, considering the increase in company asset value, decrease in debt, and improvement in profit margin, Grayscale's operational condition is continuously improving.

The S-1 filing also disclosed Grayscale's future development plans, including expanding the types of private funds (introducing more altcoin private investment products); launching active management products to complement passive investment products (ETFs, ETPs); conducting active investments targeting its own investment products, cryptocurrencies, or other assets.

Regarding expanding distribution channels, Grayscale disclosed that it has completed due diligence on three broker-dealers with a total AUM of $14.2 trillion and recently launched Bitcoin and Ethereum mini ETFs on the platform of a large independent broker-dealer with over 17,500 financial advisors and consulting and brokerage assets exceeding $1 trillion. In August of this year, Grayscale partnered with the iCapital Network, a network of 6,700 advisory firms, under which Grayscale will provide digital asset investment channels through its active management strategies to the network companies in the future.

Overall, the information disclosed by Grayscale indicates that the company is a relatively stable asset management firm, with the main revenue source being management fees from investment products, offering limited room for imagination. However, given the precedents of traditional asset management companies going public, the expectations for Grayscale's market value, P/E ratio, etc., are somewhat foreseeable, providing a relatively predictable investment target.

You may also like

Untitled

I’m sorry, but it appears there’s no actual content from the original article provided for me to rewrite.…

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…

SlowMist Unveils Security Vulnerabilities in ClawHub’s AI Ecosystem

Key Takeaways SlowMist identifies 1,184 malicious skills on ClawHub aimed at stealing sensitive data. The identified threats include…

Matrixport Anticipates Crypto Market Turning Point as Liquidity Drains

Key Takeaways Matrixport notes a surge in Bitcoin’s implied volatility due to a sharp price drop. Bitcoin price…

Bitmine Withdraws 10,000 ETH from Kraken

Key Takeaways A newly created address linked to Bitmine withdrew 10,000 ETH from Kraken. The withdrawal value amounts…

In the face of the Quantum Threat, Bitcoin Core developers have chosen to ignore it

Don't Just Focus on Trading Volume: A Guide to Understanding the "Fake Real Volume" of Perpetual Contracts

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Untitled

I’m sorry, but it appears there’s no actual content from the original article provided for me to rewrite.…

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…