How to Flip Real Estate in the Prediction Market

Original Title: "Birth of House Price 'Shorting Tool,' Polymarket Launches Real Estate Prediction Market"

Original Author: Asher, Odaily Planet Daily

"Everything is predictable," and the value of predictions is on the rise.

On the evening of January 5th, the on-chain real estate platform Parcl announced a partnership with the prediction market Polymarket, aiming to introduce Parcl's daily house price index into Polymarket's novel real estate prediction market. In response to this news, Parcl's platform token PRCL saw a short-term surge of over 150%, which has since retraced. The price is currently at $0.042, with a market cap of $19 million.

PRCL Candlestick Chart

Polymarket Real Estate Prediction Market Section Operating Rules

Partnership Details:

· Parcl provides daily housing price indices as independent, transparent reference data for market settlement;

· Polymarket is responsible for listing and operating the market, where users can trade on the Polygon chain using USDC;

· Market settlement is based on Parcl's publicly verifiable indices, avoiding the delays (usually monthly) and subjectivity of traditional real estate data.

Market Types:

· Predicting house price increases/decreases on a monthly, quarterly, or annual basis;

· Threshold markets: e.g., whether the house price will exceed a specific level; each market links to Parcl's dedicated settlement page, showing the final value, historical data, and index calculation method.

Coverage:

· Initially starting from highly liquid US cities such as New York, Miami, San Francisco, Austin, etc.;

Subsequently expanding to more cities and market types based on user demand.

Example Display:

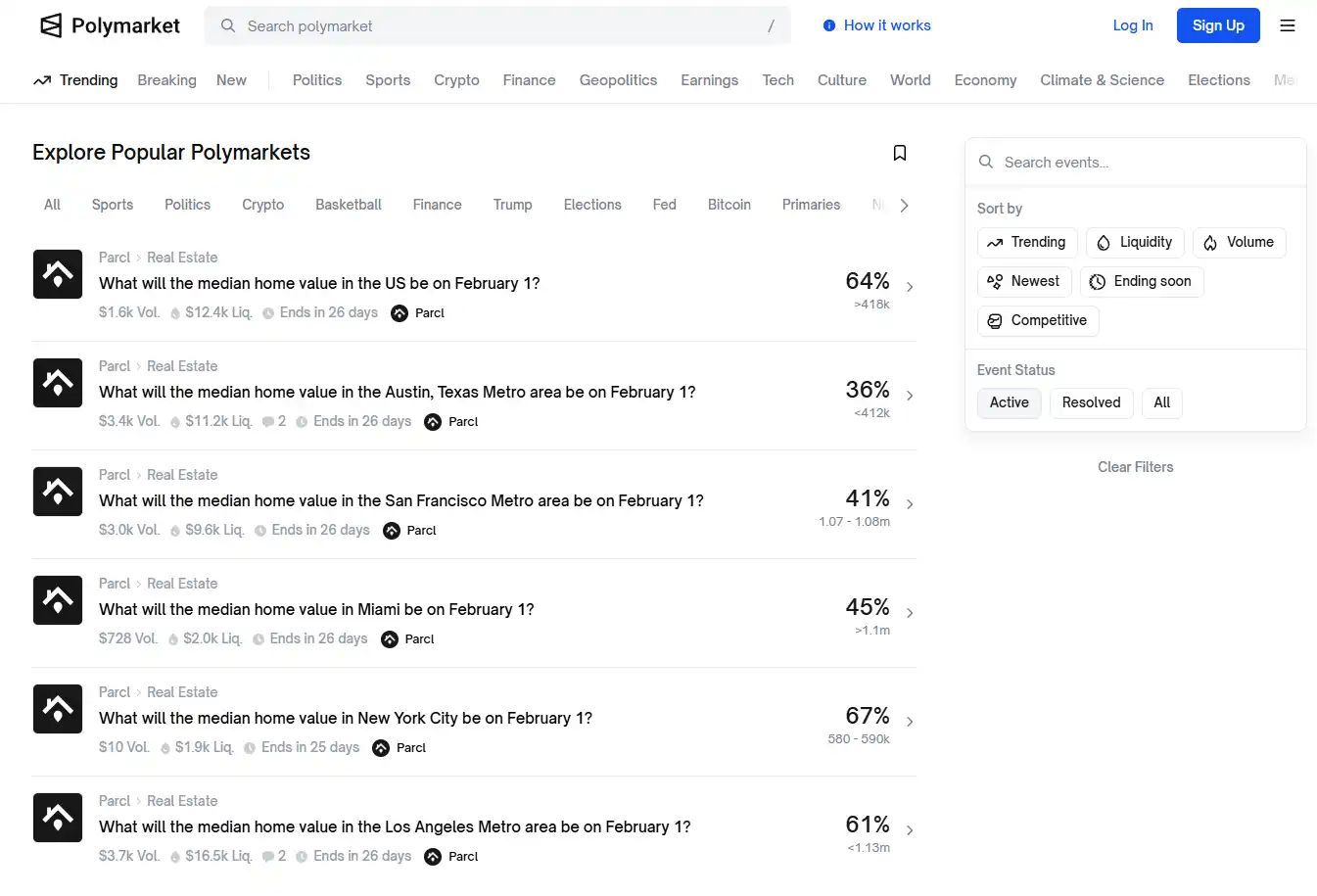

Currently, this category has only launched 7 monthly real estate prediction events, with low liquidity, and the event with the highest trading volume, "US Los Angeles February 1st Home Median Price," is only $3700.

Polymarket Introduces New Real Estate Prediction Market Category

For the traditional real estate market, whether bullish or bearish, this kind of expectation is difficult to express directly, let alone form a continuous market signal. The introduction by Polymarket essentially separates the "judgment on housing prices" from asset trading, as long as there is a clear settlement standard, the expectation itself can be priced independently.

Real Estate Market Finally Sees a "Shorting Tool"

An easily overlooked fact is that the potential demand for real estate-related markets does not only come from the native speculators of the crypto world.

In the traditional financial system, "falling house prices" is almost an unhedgeable risk. Whether holding real estate, asset structures, or income sources highly dependent on a city's real estate cycle. The real-world response is often either to continue holding or to sell physical assets directly—high transaction costs, long cycles, and a lack of flexible intermediate options. As KOL 0xMarioNawfal (@RoundtableSpace) put it: "This is much more than just betting, it is bringing liquidity to one of the world's most illiquid markets. Imagine the house price is at a historical high, and you expect a crash but can't sell the house—now you can hedge, short the market."

The introduction of prediction markets abstracts the downward trend of housing prices into a tradable risk assessment. When house prices are high and market expectations begin to weaken, the trend of real estate prices can be priced independently without the need to dispose of underlying assets for risk management.

Through Polymarket, the downside risk of real estate prices has been abstracted into a tradable judgment rather than the necessity to dispose of physical assets. From this perspective, the real estate prediction market on Polymarket is more akin to a simplified macro hedging mechanism rather than a purely speculative game of ups and downs. It has not altered the liquidity structure of real estate assets themselves but has provided a real-time trading layer that reflects expectations for a long-term illiquid market.

Polymarket CMO Matthew Modabber said: "Prediction markets are most suitable for events with clear, verifiable data. Parcl's daily house price index provides us with a transparent, consistent settlement basis, and real estate should be a primary category for prediction markets."

This collaboration between Polymarket and Parcl also brings the price signal of traditional real estate into the crypto system: What was originally a low-frequency, closed, and highly exclusive asset has been broken down into a settleable, verifiable, and tradable index outcome, resembling stock indices or crypto derivatives. This may be a practical path to ground the RWA narrative in something more realistic and closer to real-world needs.

You may also like

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

Gold Price Prediction as Tom Lee Says Metals Rally Could Hit Crypto

Key Takeaways: Gold recently reached an all-time high of $5,598, reflecting a strong investor shift towards safe-haven assets…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

Russia Caps Crypto Investments at $4,000 Annually for Non-Qualified Investors – Will Others Follow Suit?

Key Takeaways Russia’s proposal sets a $4,000 annual investment limit for non-qualified crypto investors, sparking discussions on regulatory…

Japan’s Metaplanet Announces $137 Million Capital Raise Via Third-Party Allotment

Key Takeaways Japanese firm Metaplanet Inc. has strategized a $137 million capital raising through the third-party allotment of…

Crypto Price Prediction for January 28 – XRP, Solana, Bitcoin

Key Takeaways Bitcoin price recently hit $90,000 but struggled to maintain this peak. XRP and Solana are following…

Sygnum Bank Secures Over 750 BTC for Bitcoin Yield Fund’s Growth

Key Takeaways: Sygnum Bank has raised over 750 BTC in the initial phase of the Starboard Sygnum BTC…

Asia Market Open: Bitcoin Holds Steady Near $88K Amidst Asia’s Tech Slowdown and Gold Surge

Key Takeaways Bitcoin remains stable at nearly $88,000 as Asian tech markets show signs of cooling. Global markets…

Dogecoin Price Prediction: DOGE Founder Reveals True Cause of Crypto Market Downturn

Key Takeaways: The recent downturn in the cryptocurrency market, including Dogecoin, is attributed to shifting investor behavior rather…

Optimism DAO Endorses OP Buyback Proposal with 84% Approval – What Lies Ahead?

Key Takeaways The Optimism Collective has sanctioned a plan to allocate 50% of Superchain revenue to monthly OP…

US Senators Criticize DOJ Over Crypto Crime Unit Closure Amid Financial Conflict Concerns

Key Takeaways: Six US senators have criticized Deputy Attorney General Todd Blanche for shutting down the DOJ’s crypto…

Why Is Crypto Down Today? – January 29, 2026

Key Takeaways The crypto market has fallen by 1.7% over the past 24 hours, with significant declines in…

Bitcoin Retreats as Hawkish Fed and Outflows Pressure Market: Analyst

Key Takeaways: Bitcoin’s value dipped below the $89,000 mark due to restrictive financial conditions and growing geopolitical stress.…

Strive Retires Majority of Debt and Expands Bitcoin Holdings Following Preferred Stock Offering

Key Takeaways: Strive successfully retired 92% of debt inherited from acquiring Semler Scientific, amid a significant preferred stock…

Ethereum Price Prediction: Wall Street Firm Begins to Buy and Lock ETH – Is This Brave or Insane?

Key Takeaways BitMine’s significant investment in Ethereum by securing 4.2 million ETH and staking 2.2 million ETH showcases…

XRP Price Prediction: Price Looks Stagnant – But This Key Signal Just Flashed Green After Months

Key Takeaways Recent indicators suggest a potential bullish trend for XRP, indicating a possible price surge. Traders have…

Left hand to right hand? Unpacking the financial leverage loop behind the AI boom and Wall Street’s ultimate high-stakes bet

For a company that built its brand around “safety,” its greatest historical risk exposure has come from security itself.

Navigating the Complexities of Cryptocurrency Trading

Cryptocurrency trading has surged, attracting diverse investors. Understanding market strategies and trends is crucial for success. Risk management…

Gold Price Prediction as Tom Lee Says Metals Rally Could Hit Crypto

Key Takeaways: Gold recently reached an all-time high of $5,598, reflecting a strong investor shift towards safe-haven assets…

Bitcoin’s Historical Bottom Indicator Points to $62K – Could BTC Fall That Low?

Key Takeaways Bitcoin is nearing a critical support level of \$62,000, with key indicators suggesting potential further declines.…

Bitcoin Price Prediction: Binance Inflows Just Hit a 4-Year Low – Violent Move Above $100K is Next

Key Takeaways: Bitcoin inflows into Binance have dropped to their lowest in four years, potentially signaling a tight…

Russia Caps Crypto Investments at $4,000 Annually for Non-Qualified Investors – Will Others Follow Suit?

Key Takeaways Russia’s proposal sets a $4,000 annual investment limit for non-qualified crypto investors, sparking discussions on regulatory…