Week 48 On-chain Data: Market in Good Shape, Poised for Next Movement

Original Article Title: "Hesitation and Consolidation, Is the Market's Buying Power Still Here? | WTR 12.2"

Original Source: WTR Research Institute

Weekly Review

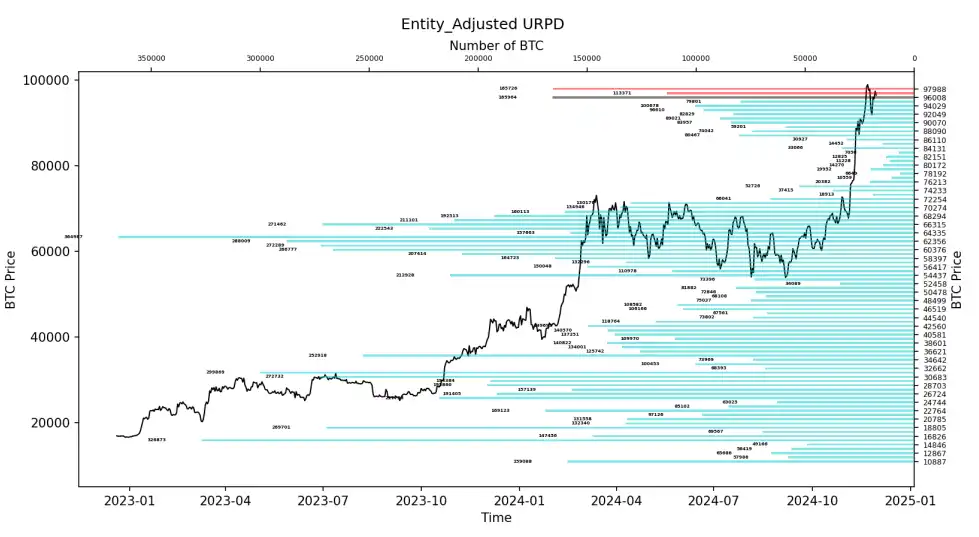

For the week from November 25th to December 2nd, the highest price of Bitcoin reached near $98,871, and the lowest approached $90,791, with a fluctuation range of about 8.17%. Looking at the chip distribution chart, there was a significant amount of chips traded around 96,000, providing some support or resistance.

• Analysis:

1. 2.24 million coins around 60,000-68,000;

2. 970,000 coins around 90,000-97,000;

• The probability of not breaking below 87,000 to 91,000 in the short term is 70%;

• The probability of not breaking above 100,000 to 105,000 in the short term is 60%.

Important News

Economic News

1. According to CME's "FedWatch": The probability of the Fed maintaining the current interest rate by December is 32.9%, and the cumulative probability of a 25 basis point rate cut is 67.1%.

2. J.P. Morgan's trading team believes the S&P 500 could reach close to 6,300 points by year-end.

3. New York Fed President Williams: Inflation is above the 2% target. Over time, it will be appropriate to allow rates to return to a neutral level.

4. German union confirms: About 66,000 Volkswagen workers are participating in a strike.

5. Intel CEO Pat Gelsinger is forced to leave the company, as the previous board lost confidence in his plan to turn the company around.

Crypto Ecosystem News

1. Coinbase's Chief Policy Officer: Expects rapid cryptocurrency regulation in the U.S. after Trump takes office.

2. Analyst Fournier points out, "The profit-taking phenomenon is evident, and a massive sell wall of over 4,000 bitcoins, approximately $384 million, must be cleared for a higher price to be reached.

3. 10x Research stated in a recent report that Bitcoin balances on cryptocurrency exchanges have reached an all-time low, and on-chain data indicates a sharp decline in the available Bitcoin for purchase.

4. Ethereum Price Rebound Drives NFT Market Recovery, with NFT Sales in November Reaching the Highest Value in Almost Six Months.

5. Hong Kong SFC: Licensing of Virtual Asset Trading Platforms in Hong Kong to be Announced by End of Year.

6. On November 30, according to Farside Investors data, yesterday's net inflow into the U.S. Ethereum spot ETF was $332 million, marking the first time in history that it exceeded the Bitcoin spot ETF (which was $320 million yesterday).

7. Trump Nominates 5 "Cryptocurrency Players" as New Government Cabinet Picks.

Long-term Insights: Used to observe our long-term situation; Bull Market / Bear Market / Structural Changes / Neutral State.

Mid-term Exploration: Used to analyze the current stage we are in, how long this stage will continue, and what circumstances we will face.

Short-term Observations: Used to analyze short-term market conditions; as well as the appearance of trends and the likelihood of certain events under certain conditions.

Long-term Insights

• Exchange Whale Transfers

• ETF Fund Reserve Flows

• U.S. Session Buying Power

• Whale Status

(See Exchange Whale Transfers chart below)

Large exchanges transfers indicate that many high-net-worth participants are still showing a significant buying interest.

(See ETF Fund Reserve Flows chart below)

ETF fund reserves have returned to a positive direction, but not as dramatically and fiercely as before. The overall market sentiment is still relatively positive.

(See U.S. Session Buying Power chart below)

U.S. session buying power is trending positively, with a strong atmosphere in the Americas.

(See Whale Status chart below)

Whales continue to make purchases. Apart from a slightly increased pressure, the overall market is still being supported by relatively strong new entrants and buying power.

Mid-term Exploration

• Network Sentiment Positivity

• Whale Buying Power Composite Score

• USDC Buying Power Composite Score

• WTR Risk Observation Indicator 1

• ETF Channel Fund Inflow-Outflow Changes

(Network Sentiment Positivity)

Recently, there has been a noticeable decline in network sentiment, with the current value continuously decreasing. It is possible that overall on-chain transaction enthusiasm has decreased.

(Whale Comprehensive Score Model)

Whales still show a high score performance, indicating they may still have a strong holding intention, and the overall group's participation enthusiasm is high.

(USDC Buying Power Comprehensive Score)

USDC's buying power remains very strong, with a high score even during high volatility periods. U.S. session users may not have a collective intention to exit the current market.

(Risk Observation Index 1)

Comparing the risk between BTC and ETH, the current hidden risk within the market may still be concentrated on ETH. The recent rapid rise in ETH's risk coefficient may be a challenge the market needs to face.

(ETF Channel Fund Flow Changes)

The fund flow in the ETF channel has slowed down, with relatively cautious participation. The current market pace may experience an overall contraction, waiting for a significant turning point with momentum.

Short-Term Observation

• Derivative Risk Coefficient

• Options Intent-to-Trade Ratio

• Derivatives Trading Volume

• Options Implied Volatility

• Profit and Loss Transfer Amount

• New and Active Addresses

• Exchange Net Long/Short Ratio

• Ape1 Exchange Net Long/Short Ratio

• Heavy Selling Pressure

• Global Buying Power Status

• Stablecoin Exchange Net Long/Short Ratio

• Off-chain Exchange Data

Derivatives Rating: The risk coefficient is in the red zone, indicating an increase in derivative risk.

(Derivative Risk Coefficient)

Last week, the market was more inclined towards consolidation, with the risk coefficient close to the neutral zone. This week, the market still relies more on incremental changes, and derivatives have a relatively small impact on the market.

(Options Intent-to-Trade Ratio)

Put Option Sentiment is high, while trading volume is at a moderate level.

(Derivatives Trading Volume Chart)

Last week, it was mentioned to wait for the market to see the next move when derivative trading volume is low. After a small pullback last week, the trading volume has once again dropped to a low level, indicating that a new round of volatility is expected this week.

(Implied Volatility of Options Chart)

The implied volatility of options has not changed much.

Sentiment Status Rating: Neutral

(Profit/Loss Transfer Amount Chart)

Market sentiment has shifted from last week's greed to a neutral zone.

Positive market sentiment has slightly decreased, and panic sentiment has not risen significantly, indicating that the market is still in a healthy state.

(New and Active Address Chart)

New and active addresses are at a high level.

Spot Market and Selling Pressure Structure Rating: BTC is in a state of significant outflows, while ETH has overall cumulative inflows.

(Exchange Net Flows of BTC)

BTC exchange net flows continue to show significant outflows accumulation.

(Exchange Net Flows of ETH)

ETH exchange net flows, although showing some outflows, are still in an overall inflow accumulation status.

(High Weighted Selling Pressure)

Selling pressure from old addresses has eased slightly.

Buy Pressure Rating: Global Buy Pressure and Stablecoin Buy Pressure remain stable compared to last week, both in a positive recovery state.

(Global Buy Pressure Status Chart)

Global purchasing power is basically unchanged from last week.

(See USDC Exchange Net Headroom chart below)

Stablecoin purchasing power is at a similar level to last week, showing a positive rebound.

Off-chain Transaction Data Rating: Buying interest at 94000; Selling interest at 100000.

(See Coinbase Off-chain Data chart below)

Buying interest is seen around 84000-90000 and 94000;

Selling interest is seen around 100000.

(See Binance Off-chain Data chart below)

Buying interest is seen around 84000-90000;

Selling interest is seen around 100000.

(See Bitfinex Off-chain Data chart below)

Buying interest is seen around 84000-90000;

Selling interest is seen around 100000.

Weekly Summary

News Highlights

1. September 2024 became the fourth-largest rate-cutting month of the century, with a total of 26 central banks worldwide implementing rate-cutting policies.

2. This trend continued into November, marking a new phase in global monetary policy.

3. Looking ahead to 2025, the market generally expects the Federal Reserve to further cut rates by 1-1.5 percentage points.

4. Against this backdrop, major central banks worldwide may follow the Fed's lead to further improve the liquidity environment.

5. Optimism remains for the performance of the capital markets in 2025.

On-chain Long-term Insights:

1. Large exchanges' transfer of funds still indicates significant buying interest;

2. ETF fund reserve flows show a slight warming up of market buying interest;

3. Positive and Active Buying Power in the U.S. Session;

4. Whales' Leaders are Relatively Positive Buyers.

• Market Tone:

Buying support continues, needing to absorb the profit-taking pressure from long-term participants that occurred previously.

On-chain Medium-term Exploration:

1. Decline in on-chain participation enthusiasm;

2. Whale community still has a high willingness to hold;

3. U.S. userbase did not show a collective withdrawal phenomenon;

4. Current risk mainly concentrated on ETH;

5. ETF inflows have become cautious.

• Market Tone:

Cautious

The current phase is likely a moderation stage, with high on-chain key group participation enthusiasm, but overall participants have become somewhat cautious.

On-chain Short-term Observation:

1. Risk coefficient is in the red zone, derivative risk is increasing;

2. New active addresses are at a high level, market activity is high;

3. Market sentiment rating: Neutral;

4. Exchange net leaders overall show BTC in a large outflow state, with ETH in overall accumulation;

5. Global buying power and stablecoin buying power are steady compared to last week, both in a positive rebound state;

6. Off-chain transaction data shows willingness to buy at 94,000; willingness to sell at 100,000;

7. There is a 70% probability that the short-term price will not fall below 87,000 to 91,000; with a 60% probability that the short-term price will not rise above 100,000 to 105,000.

• Market Tone:

Market positive sentiment has shifted from high to neutral, and the overall short-term market status is good. The next wave is building up.

Risk Warning: The above is all market discussion and exploration, not directional opinions for investment; please handle with caution and beware of market black swan risks.

This article is contributed content and does not represent the views of BlockBeats.

You may also like

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

Coinbase UK Executive Declares Tokenised Collateral a Mainstream Financial Force

Key Takeaways Tokenised collateral is transitioning from its initial experimental stages into becoming core infrastructure within financial markets.…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market witnesses volatility amid a technology-sector selloff, but opportunities still exist for keen investors.…

Why Is Crypto Down Today, February 6, 2026

Key Takeaways The global cryptocurrency market has seen an 8% decline in the last 24 hours, standing at…

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

Earn

Earn